-

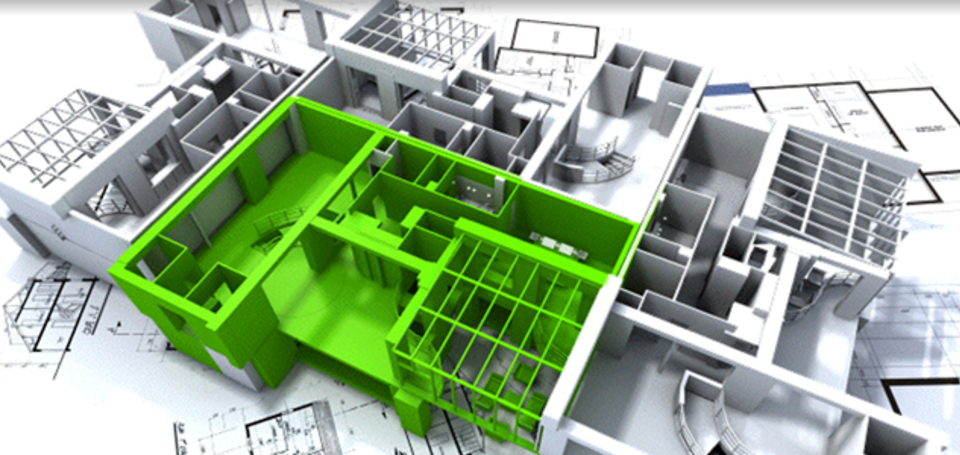

focusing on the green investment prospect

focusing on the green investment prospect -

to reveal the hidden value

to reveal the hidden value -

in real estate and urban infrastructure

in real estate and urban infrastructure -

through efficient and sustainable use of resources

through efficient and sustainable use of resources -

asd

Green Value Associates goal is to work with its clients to unlock and enhance value in existing real estate and infrastructure assets through the realisation, among other things, of any greener standard and energy efficiency potential as well as sustainable operational effectiveness.