-

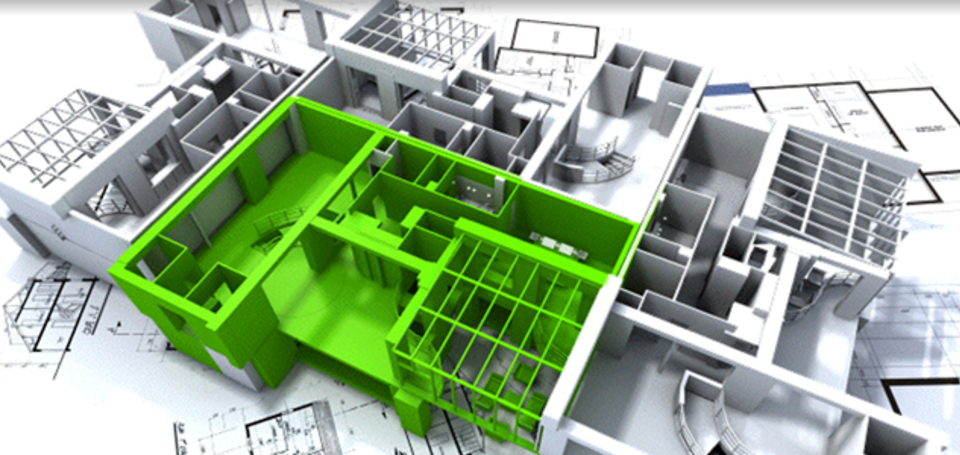

focusing on the green investment prospect

focusing on the green investment prospect -

to reveal the hidden value

to reveal the hidden value -

in real estate and urban infrastructure

in real estate and urban infrastructure -

through efficient and sustainable use of resources

through efficient and sustainable use of resources -

asd

- Recommended on the possible options for the establishment, organisation, administration and operation of a Special (National) Energy Efficiency Fund in line with EU EED Article 20 guidelines. The recommendations included proposals on its possible funding resources.

- Provided in depth benchmarking analysis of commercial property and related energy use data from more than 100 leading business with presence in London. The benchmarking analysis also performed peer-to-peer comparison by property and industry sector.

- Co-developed an alternative data aggregation tool on behalf of a major metropolitan authority for a business energy challenge, where participating business needed to occupy more than 500m². Coordinated also the business recruitment through targeted communication.

- Aggregated and analysed related energy use data for c.1,600 property in London and subsequently calculated and compared their energy savings on an annual basis. The assessed data revealed also their overall carbon emissions reduction during a 4 year period.

- Provided technical due diligence to one of the largest REIC in Greece during the acquisition of major big-box retail and office buildings. Energy efficiency potential was assessed and the impact of future operational and maintenance costs on an NPV basis was calculated (>€5 million in total).

- As part of a multi-disciplinary consulting team, GVA advised the business ownership of two adjacent aluminium recycling industrial facilities on how to improve energy efficiency to achieve annual savings of more than €1 million (15-20% reduction). The measures proposed included process re-engineering initiatives.

- Advised a government Defense Agency on a strategic EU funded (€30m) capital programme aiming to upgrade core estates. Based on a set of defined criteria, GVA assessed the estates portfolio, analysed energy management operations and proposed strategic improvement solutions aiming to produce up to €20m annual operating cost savings.

- Advised the senior management of a large Corporate Real Estate subsidiary on an asset management strategy. GVA focused on the allocation of the annual maintenance budget (€2m annually available) in its real estate portfolio (commercial and industrial) to preserve and/or enhance existing value.

- Drafted the fund raising strategy for a new pan-European added-value real estate retrofit fund (c. £150-200m). GVA's work included pitch documentation preparation, pipeline identification and potential LPs investors long list assessment.

- Proposed a project pipeline sourcing strategy to a newly incorporated UK based Energy Efficiency Fund. GVA's work included a long list of potential businesses, service providers, banks and similar investors, who could have projects to offer or co-finance.

- Worked with a major UK landlord’s in-house team in a real estate retrofit investment programme (£5m annually) on sequence, monitoring, reporting and options for co-financing. GVA worked together with an energy monitoring provider to analyse building and energy data.

- Worked together with the asset managers of a 25,000sqm office building to increase the existing market value by £4m with a £400k retrofit upgrade project. GVA's work also included the investment returns modelling based on anticipated cash flows.

- Supported the fund raising exercise of a major RES developer (mainly wind and hydroelectric power) to form a new investment vehicle to finance its existing pipeline (288MWp under construction + 5,000MWp under consideration/planning).