-

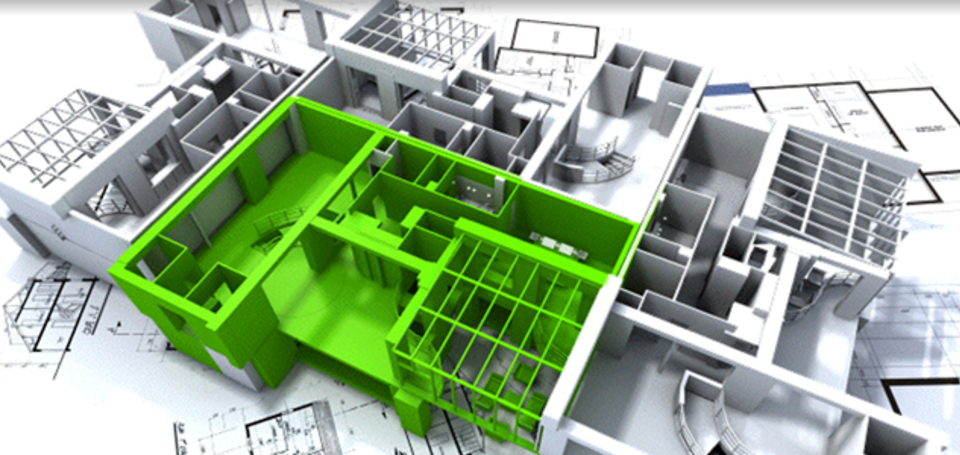

focusing on the green investment prospect

focusing on the green investment prospect -

to reveal the hidden value

to reveal the hidden value -

in real estate and urban infrastructure

in real estate and urban infrastructure -

through efficient and sustainable use of resources

through efficient and sustainable use of resources -

asd

Consensus is broad that any successful approach to sustainable investments must include the upgrade of the existing building stock. As an example, nearly one-half of all energy consumed by commercial buildings could be avoided through green retrofit and energy efficiency upgrades, whose cost would generally payback within five years or less due to the realisable energy and operational savings.

At the same time, the traditional methods of assessing real estate investment risk - such as standard deviation of returns, projected vacancy rate and forecast rental growth - fall short in a market in which the basic patterns are undergoing major transformation.

Future commercial and residential buildings need to be built based on a new sustainable standard. Existing buildings need to be retrofitted. This is because greener commercial properties prove quicker to transact, attract and retain more and better quality tenants, and are more liquid and should, therefore, attract a lower risk premium.

Global property groups and other long-term real estate investors have long realised that their future success is tied to their sustainable growth. This depends on preserving real estate capital values and generating sustainable rental income. Therefore, they have a vested interest in creating and managing a resilient, adaptable and sustainable portfolio of commercial buildings.

GVA helps investors in upgrading their existing real estate portfolios or in buy-fix-sell strategies attempting always to answer the value impact question. And to do this rightly, GVA focusses on the 3 areas that generate better returns:

- Revenue; due to higher rental income than in ordinary buildings as a result of lower service charges, decreased void periods and reduced tenant churn.

- Profits; from improved capital values due to higher revenues and lower exit yields as a result of enhanced attractiveness to good covenant occupiers conscious about long-term occupation of sustainable buildings.

- Intangible benefits; such as boosting investors' brand value and reputation due to enhanced sustainability credentials and reduced exposure to associated environmental and climate change risks.

Based on which of these categories a sustainable retrofit initiate fits into, GVA measures and verifies its value impact. And to quantify the value generated at an asset or portfolio level, GVA integrates existing tools, benchmarks and techniques that measure commercial real estate performance.