-

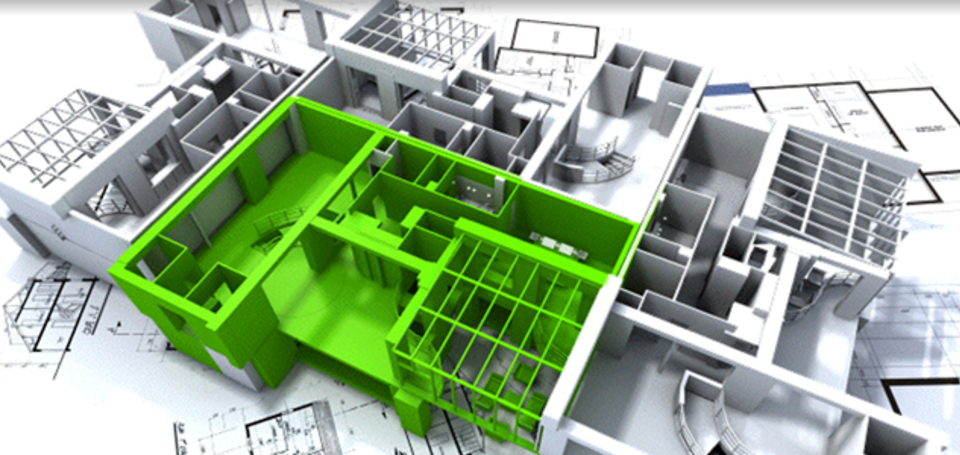

focusing on the green investment prospect

focusing on the green investment prospect -

to reveal the hidden value

to reveal the hidden value -

in real estate and urban infrastructure

in real estate and urban infrastructure -

through efficient and sustainable use of resources

through efficient and sustainable use of resources -

asd

Exploring the benefits and risks through the utilisation of specialist finance and delivery structures.

Matthew Ulterino, Principal, Rodin Consulting & Senior Advisor, Green Value Associates.

Chris Panfil, Vice President, WATG

Trends

Trends in energy generation and management, and in local distribution, are making viable ever greater shares of distributed power. The profound price drops in photovoltaic panel prices have significantly lessened the upfront financial costs. Ancillary price and technology improvements in two-way grid communications and metering, local storage and demand management are commensurately improving resource efficiency and allocation. In combination, these can feed individual and community aspirations for energy autonomy – generating and controlling sufficient energy resources in lieu of traditional centralised suppliers and contracting arrangements with their inevitable price volatility. At the building scale, there are great opportunities to both reduce energy demand, and to generate low-carbon power in-situ or within a community arrangement.

Coinciding with these trends, the EU’s Energy Performance of Buildings Directive (EPBD) effectively obligates member states to deliver regulatory building code changes leading toward net-zero energy buildings in less than a decade. In practice, this will require highly energy efficient buildings to generate a portion of their energy demand through on-site low-carbon power and rely on closely sited renewables for the balance, as needed. It is clear that developers of large, master planned property projects – involving land subdivision and delivery of dozens to hundreds of housing units, commercial spaces, tourism, leisure and community facilities - have the design tools and the long-term regulatory vision at their disposal to guide decisions for low-energy design and on-site renewable energy infrastructure provision. Moving toward greatly reduced demand and local generation can clearly provide benefits for securing planning consents; in offering near-term product differentiation and long-term asset value maintenance; and controlling energy price variability for building owners and occupiers.

Challenge

Few, however, choose this path as a matter of course. It continues to be seen as an option entailing greater risk and cost than conventional property design and delivery pathways that simply tie into existing centralised power grids.

Within the property sector, there appears to be very little interaction and crossover with related professionals in renewable energy project finance and delivery. Similarly from the perspective of an energy project developer, executing new projects within a property development footprint presents its own risks due to the unfamiliarity and minimal crossover between the sectors, as well as factors of time and scale. Though both the property and energy developer seemingly have something to gain from a linked project development process, each have access to more tried and true delivery pathways that offer the least resistance.

In large-scale property development projects striving for excellence in environmental design, the potential of energy efficiency and on-site low-carbon energy generation allows for demand reductions to leverage the remarkable performance and cost gains being realised in distributed renewable technologies. These factors – where supported by regulatory and market certainty – offer great promise to property developers seeking market differentiation and long-term value. Many projects, however, fail in the transition from intent to practice. ‘Green’ solutions conceived at concept stage and in early detail design face many obstacles as projects move toward full design, financing and construction.

Financing

A possible means to maintain this early-stage intent within a large-scale development project is to separate the property and energy financing so as to seek separate specialist debt and equity sources to fund the renewable energy assets, alongside innovative lease agreements between the underlying property asset and the overlaying energy source. To execute the strategy, a level of upfront effort and innovation from both parties will be required as the phasing could be a challenge. One can anticipate either a special purpose vehicle (SPV) where both parties – energy and property developers – take an equity stake to move the project toward financing or a more of a private equity model - supported by conventional debt finance. Delivering the ground-mounted generation on land that is surplus to the proposed built area should be prioritised.

Benefits

In brief, the benefits of co-located and concurrently developed assets can be summarised as follows:

- Project developers for large scale master plans will be responsible for costs to extend or link to existing power lines tied to centralised grids. Separating and assigning the energy asset delivery to a different development partner can lessen the capital outlay.

- If a project plan is put forward that embeds onsite generation as part of the overall property finance package, the risk weighting assigned to it may negatively alter the entire package. Bringing in a separate finance and development team for the energy component lessens the risk to the project’s debt and equity investors on the property side, and allows the energy concept plan to be executed.

- Mixed-use developments that include many different building types and uses can create energy balance benefits for maximising on-site thermal and electric energy supply and storage options. This can lead to complete energy self-sufficiency in certain circumstances, obviating the need for grid connections. The proximity between generation and consumption also propels energy awareness amongst consumers.

- Securing the consents required to deliver a large-scale property project represents a sunk cost to the project developer. Therefore, the property developer can take advantage of the energy developer’s professional and technical skills as well as incremental time and effort required to achieve the energy asset regulatory permitting and share the regulatory planning costs.

- The long-term ownership interest in the energy assets - assumed feed-in tariff, property mix occupancy profile and predictable demand - suggests a realisable return on investment can be secured.

Conclusion

The regulatory mandates that will be filtering through the European property sector over the next decade will make a necessity of effective finance and deployment of on-site renewables – irrespective of the future proofing advantages that local energy generation confers. A financial and delivery partnership approach between property and energy asset developers can reduce risks and broaden opportunities to both parties where substantial crossover is presently lacking.

Fortunately, there appear to be ample sources of ‘green’ finance available through socially conscious long-term investors such as pension funds; from investor and fund management firms with experience in financing energy efficiency; and individual investors of various sizes. Similarly, a class of property developers who are sympathetic to the aims of a lesser environmental footprint and renewable supply perhaps only need the right partner and modest modifications to their typical project execution strategy to find the risks have been effectively managed. There will not be a one-size-fits-all approach, as individual project circumstances and the local context will vary.

Note: The viewpoint article is based on a paper written by the authors on the opportunities, benefits and risks of co-developing property and energy assets utilising specialist finance and delivery structures.