-

an advisory and management services boutique

an advisory and management services boutique -

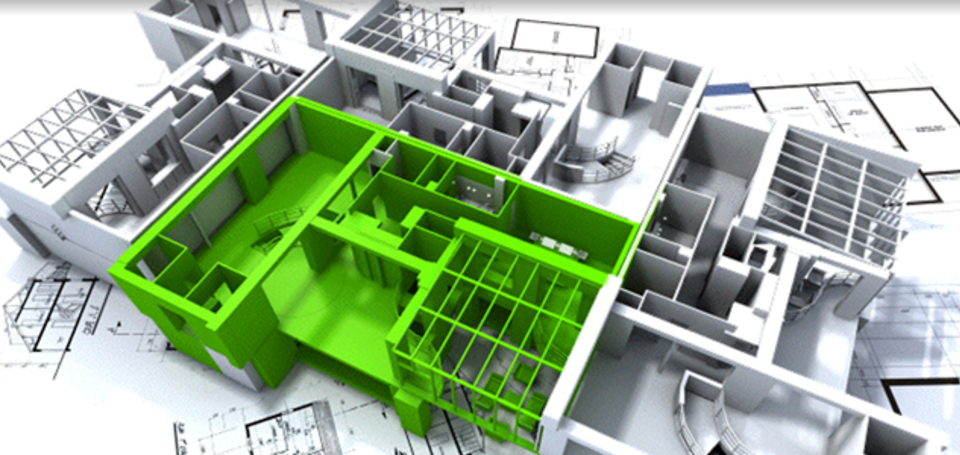

focusing on the green investment prospect

focusing on the green investment prospect -

to reveal the hidden value

to reveal the hidden value -

in real estate and urban infrastructure

in real estate and urban infrastructure -

through efficient and sustainable use of resources

through efficient and sustainable use of resources

Green Value Associates assesses, originates and manages sustainable investments in real estate and infrastructure assets eligible for 3rd party finance.

Projects identification and benefits assessment

Green Value Associates (GVA) works with its clients to assess and analyse strategically existing asset portfolios with the aim to identify project opportunities that improve performance and realise value. GVA identifies among other opportunities energy efficiency upgrading projects and organises them into a plan of action to drive significant results safe and reliably.

With the support of its partners, GVA’s advisory work includes:

- Asset portfolio strategic analysis with site inspections as needed

- Due diligence on sustainability, operating, energy and carbon matters

- Financial evaluation of options with modelling and payback analysis

- Clear understanding and identification of projects opportunities

- Robust and verified business case development

- Action plan for internal buy-in

GVA clarifies the value proposition to clients in a robust business case, which includes as an initial step a strategic scoping study that assesses and narrows down a short list of options, not just one preferred solution, for additional value creation.

The business case also includes:

- Technology innovation mapping to provide a context around best-practices, proven and emerging technologies

- Legislation assessment, since the potential solutions will be grounded within the local regulatory environment partly driven by EU strategies

- Carbon regulation review to provide information on anticipated legislative evolution or changes enacted in international jurisdictions